Sarthi for

Loan Management System (LMS)

Sarthi is a secure, post-disbursement automation platform designed for lending institutions to efficiently manage EMIs, collections, legal recovery, documentation, and compliance — all from a single dashboard.

SARTHI – Post-Disbursement Automation for Lending Excellence

Sarthi LMS (Loan Management System) by Multify Solutions Pvt. Ltd. is an intelligent, compliance-ready platform for managing everything after a loan is disbursed. From EMI scheduling to legal workflows, collections to document issuance — LMS gives you control, efficiency, and visibility across your loan portfolio.

Watch Demo

Explore how Sarthi LMS empowers lending institutions with complete post-disbursement loan lifecycle management — enabling seamless collections, account servicing, renewals, and compliance tracking.

Why Sarthi Is The Ultimate One-Stop Post-Disbursement Solution ?

Unlike generic tracking apps, Connect is purpose-built for mission-critical field operations. Whether you're in lending, insurance, sales, or services — Connect gives you performance control like never before.

AI-Powered Customer Journey Automation

Bucket-Wise Case Flow & CRM Workflow

45+ API Integrations with Auto-Failover

AI Credit Scoring + BRE Rules

End-to-End Disbursement Tracking

Enterprise-Grade Security

Sarthi LMS – Feature Highlights

Empowering Lending Operations with Speed, Control, and Intelligence.

End-to-End Loan Lifecycle Management

From disbursement to closure, manage every stage of the loan lifecycle effortlessly. Sarthi LMS supports multiple loan products, EMI schedules, and repayment tracking.

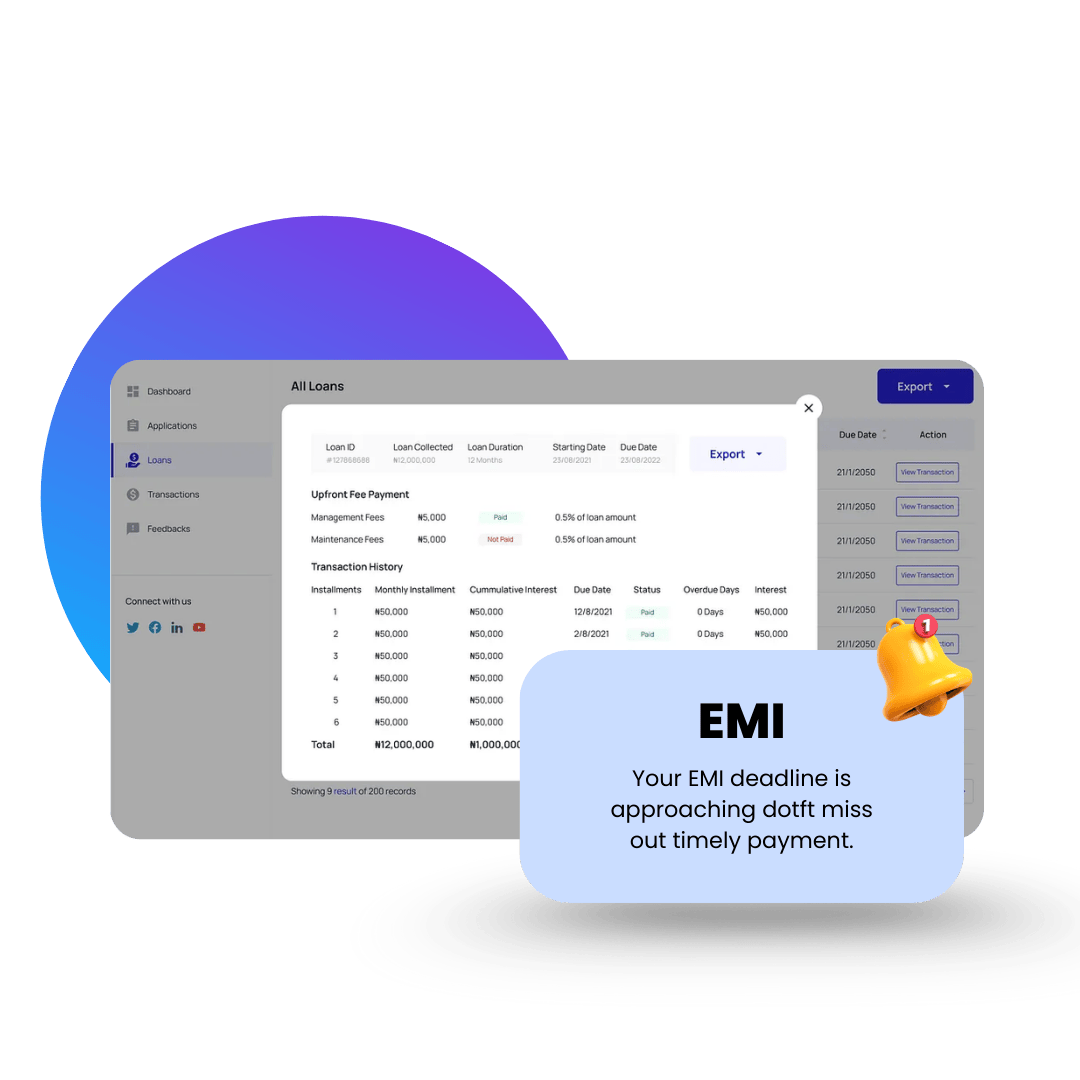

Real-Time EMI Tracking & Alerts

Track EMIs with precision and send automatic reminders to customers via SMS, WhatsApp, and app notifications—minimizing default risks and improving collections.

Role-Based Access & Branch Control

Assign specific permissions and visibility based on user roles and branch locations. Sarthi ensures data confidentiality while improving branch-level accountability.

Auto NPA Classification & Reporting

Automate NPA recognition as per RBI norms and generate audit-ready reports instantly. Stay compliant and reduce manual dependency in financial tracking.

Integration with LOS & Accounting Tools

Sarthi LMS integrates seamlessly with Sugam LOS, accounting software, and payment gateways for a complete digital lending ecosystem.

What Our Clients Say

Discover why businesses trust us to deliver exceptional results and innovative solutions

Parmeshwar Sahu

CEO, Tech Solutions

"Very satisfied with the work quality and timely delivery. The communication was clear throughout the project and the final output exceeded our expectations. Their attention to detail and professional approach made all the difference."

Frequently Asked Questions

What is Sarthi – LMS?

Sarthi – Loan Management System is a comprehensive post-disbursement loan servicing platform that helps financial institutions efficiently manage the complete loan lifecycle, from repayment tracking to account closure. It ensures accuracy, compliance, and customer satisfaction throughout the process.

Who can use Sarthi – LMS?

Sarthi – LMS is ideal for NBFCs, microfinance institutions, banks, and other lenders that want to streamline loan servicing operations, monitor repayments, and manage customer accounts effectively.

What functions does Sarthi – LMS handle?

Sarthi – LMS handles repayment scheduling, EMI collection tracking, penalty calculations, foreclosure processing, customer communications, and compliance reporting — all in one integrated platform.

Does Sarthi – LMS integrate with payment gateways?

Yes, Sarthi – LMS integrates with multiple payment gateways to enable seamless online repayments and automated reconciliation of loan accounts.

Can Sarthi – LMS handle multiple loan types?

Absolutely. Sarthi – LMS supports all loan types, including personal, vehicle, business, gold, and mortgage loans, with customizable repayment structures to suit your products.

What are the benefits of Sarthi – LMS?

Sarthi – LMS improves operational efficiency, reduces manual errors, ensures compliance with regulatory norms, and provides real-time visibility into loan performance, helping lenders improve collection rates and customer service.

Our Values

We combine innovation, experience, and 24/7 support to deliver high-quality IT solutions that power your business forward.

Innovation

We constantly push boundaries and explore new technologies to deliver cutting-edge solutions.

Excellence

Quality is at the heart of everything we do from code to customer service.

Collaboration

We work closely with our clients as partners to achieve shared success.

Agility

We adapt quickly to changing needs and deliver solutions with speed and precision.